고정 헤더 영역

상세 컨텐츠

본문

1 million registered on the first day of Apple Pay

Samsung-Naver alliance 'combatting'

Announcement of changes in the simple payment market

Apple Pay, iPhone users are expected to flow in...

Samsung-Naver Pay "Merchant Payment Link" Kakao Pay also discusses Samsung Pay link

Samsung and Naver have formed an alliance in the simple payment market.

Korean companies seem to have launched a counterattack by connecting online and offline to the craze for Apple Pay, which has registered more than 1 million cases in a day.

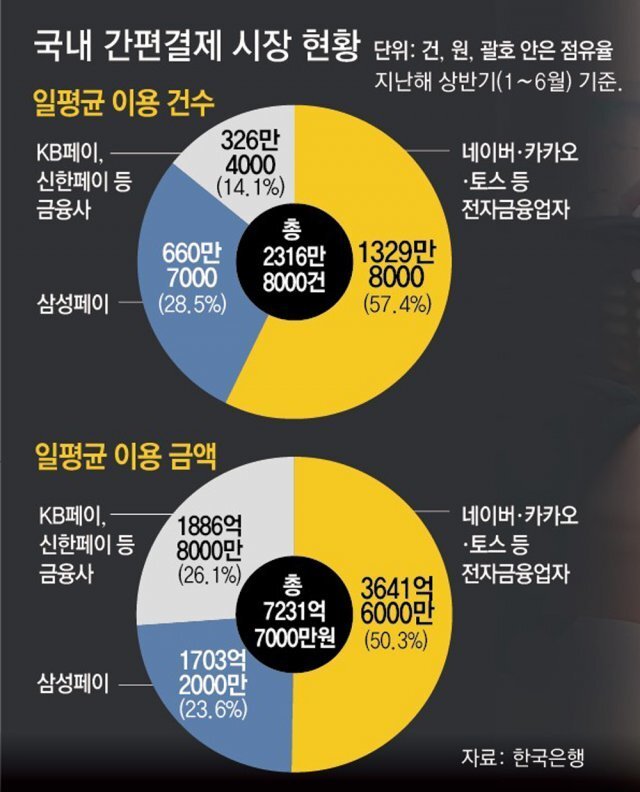

Fierce competition has begun for the domestic simple payment market with an average daily payment amount of 723.1 billion won.

● Samsung-Naver Simple Payment Market Alliance

Samsung Electronics announced on the 22nd that it will start a collaboration service between Samsung Pay and Naver Pay.

From the 23rd, payments using Samsung Pay will be available at 550,000 online on-demand franchises, including Naver Smart Store.

Previously, only Naver Pay or credit card payments were made.

Within this month, you can pay with Naver Pay at about 3 million offline stores where you can pay for Samsung Pay's MST.

Previously, only QR payments were available to use Naver Pay offline, so it was only available at 120,000 stores such as convenience stores and bakeries.

Through the alliance between Samsung and Naver, Samsung Pay will expand its scope to online and Naver Pay to offline.

Analysts say that the background of Samsung Pay and Naver Pay, whales in the domestic simple payment market, joining hands is the emergence of a "catfish" called Apple Pay.

Discussions on collaborative services between Samsung Electronics and Naver Financial reportedly accelerated after news of the introduction of Apple Pay in Korea.

According to the information technology (IT) industry, Kakao Pay is also discussing ways to link it with Samsung Pay.

● More than 1 million registered on the first day of Apple Pay service

On the 21st, the first day of the service, Apple Pay made a splendid debut with more than 1 million registrations.

Critics point out that it is a "half pay" due to the lack of transportation card functions, support only Hyundai Card, and lack of NFC terminal infrastructure.

Chung Tae-young, vice chairman of Hyundai Card, said on his social network service (SNS) account on the 22nd, "As of 10 p.m. on the 21st, the issuance of Apple Pay tokens exceeded 1 million.

" The Apple team said, "It is the best record ever," and we will slowly look at the specific meaning and standards.

" Token is a number that encrypts and issues card information when registering a credit card with an Apple Pay device.

If one card is registered on the iPhone and Apple Watch, two tokens are issued.

Currently, Apple Pay is available at most major retailers.

Major convenience stores such as GS25, 7-Eleven, CU, and E-Mart 24 and large discount stores such as Lotte Mart and Homeplus are also included.

Among department stores, Apple Pay is only available at Hyundai Department Store and Lotte Department Store.

Galleria Department Store is considering whether to introduce it or not.

In the case of Shinsegae Group, Apple Pay is not available at Shinsegae Department Store and E-Mart except for E-Mart 24, a convenience store.

Apple Pay is not available at Starbucks, which is the same affiliate.

● Easy payment market is expected to change due to 'catfish effect'

The rapid growth of Apple Pay is expected to bring about a change in the domestic simple payment market.

According to the Bank of Korea, the average daily use of domestic simple payment services reached KRW 723.1 billion in the first half of last year (January to June).

Among them, electronic financial companies such as Naver Pay, Kakao Pay, and Toss accounted for 50.3% (364.1 billion won), financial companies such as KB Pay and Shinhan Pay accounted for 26.1% (188.6 billion won), and Samsung Pay accounted for 23.6% (177.32 billion won).

Before the introduction of Apple Pay, iPhone users had to use simple payment services provided by electronic financial companies or financial companies.

With the landing of Apple Pay, the share of these simple payment services is expected to naturally decrease.

Apple's share in the domestic smartphone market is 20-30%.

An official from the financial industry said, "It may be a fresh experience for iPhone users, but Apple Pay does not seem to be providing significant benefits enough for Galaxy smartphone users to change their smartphones right now."

All right reserved : https://n.news.naver.com/mnews/article/020/0003486993?sid=101

'Latest News' 카테고리의 다른 글

| Yellow Dust (0) | 2023.03.25 |

|---|---|

| World's 2nd-largest Ferris wheel to be built in Seoul by 2027 (0) | 2023.03.24 |

| Night bus service resumed between Incheon airport, Seoul (0) | 2023.03.22 |

| Spring Flower Tourism Train 🌸 (0) | 2023.03.16 |

| No mask subway and bus (0) | 2023.03.15 |

댓글 영역